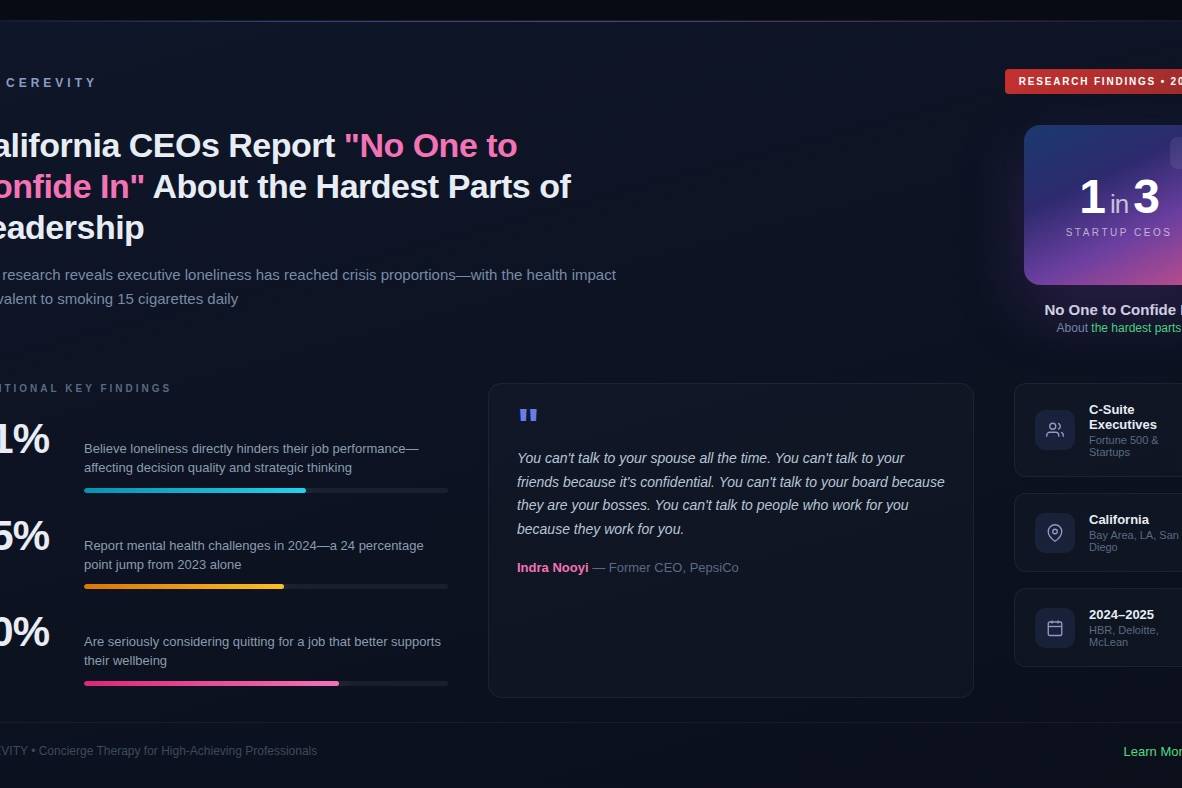

Post-Traumatic Stress Disorder (PTSD) affects millions of people and requires specialized treatment for effective management. However, concerns about the cost of therapy, medication, and other treatments may prevent many people from seeking help. If you’re wondering whether PTSD treatment is covered by insurance, you’re not alone. This article offers an in-depth look at PTSD insurance coverage, the Mental Health Parity Act, and available options for affordable treatment.

What Is PTSD, and Why Is Treatment Important?

PTSD is a mental health condition that can develop after experiencing a traumatic event, such as a natural disaster, accident, or military combat. Common symptoms include flashbacks, nightmares, severe anxiety, and uncontrollable thoughts about the event. To understand how PTSD relates to broader mental health issues, read our guide on Acute Stress Reaction.

Fortunately, various treatment options are available, including therapy, medication, and in-patient care. Research shows that PTSD treatments, particularly Cognitive Behavioral Therapy (CBT) and exposure therapy, can be effective in managing symptoms and helping individuals regain control over their lives.

Therapist Insight: “Seeking treatment for PTSD can be life-changing. Therapy and medication have proven to be effective, and today, most insurance providers recognize the importance of mental health care,” says Dr. Tessa Armich, a licensed mental health counselor with experience in trauma-focused therapy.

The Mental Health Parity Act: A Step Toward Equal Coverage

In the United States, the Mental Health Parity and Addiction Equity Act (MHPAEA) requires insurance providers to offer equal coverage for mental health conditions, including PTSD, and physical health conditions. This law mandates that insurers cover mental health treatments with the same benefits, copays, and limits they would apply to physical health treatments. While MHPAEA is a significant step forward, the specific level of coverage for PTSD varies depending on your insurance provider and plan.

Does Insurance Cover PTSD Assessments?

For those wondering if insurance covers PTSD assessments, the answer is generally yes. Most health insurance plans include coverage for initial assessments and diagnostic appointments, as these are essential for establishing a formal PTSD diagnosis. However, the cost can vary based on the type of plan, whether you see an in-network provider, and other factors. It’s a good idea to check with your insurance company to determine your out-of-pocket costs for the initial assessment.

Coverage for PTSD Treatment: Therapy, Medication, and In-Patient Care

Insurance coverage for PTSD treatment often includes various options, from therapy to medication. Here’s a breakdown of what’s typically covered:

1. Therapy for PTSD

Therapy is one of the primary treatments for PTSD, and most insurance plans cover various forms, such as cognitive behavioral therapy (CBT), eye movement desensitization and reprocessing (EMDR), and exposure therapy. Learn more about therapy techniques in our article on Prolonged Exposure Therapy.

Therapy Options for PTSD:

- Cognitive Behavioral Therapy (CBT): A highly effective form of therapy that focuses on changing negative thought patterns.

- Exposure Therapy: Helps individuals confront and process trauma-related memories in a safe environment.

- Eye Movement Desensitization and Reprocessing (EMDR): A specialized therapy that uses guided eye movements to reduce distress associated with traumatic memories.

Expert Tip: “Some insurance plans may limit the number of covered therapy sessions. If you’re concerned about cost, look into whether you can use a Health Savings Account (HSA) for additional therapy,” Dr. Armich recommends.

2. Medication for PTSD

Medications, including SSRIs and other antidepressants, are often prescribed to manage PTSD symptoms like anxiety and depression. Many insurance providers cover at least part of the cost of these medications, but the specific coverage may vary. It’s essential to confirm with your provider whether the prescribed PTSD medications are included in your plan.

3. In-Patient Treatment for PTSD

In-patient treatment can be necessary for severe cases of PTSD, especially when symptoms are debilitating. Some insurance plans cover in-patient mental health treatment, including stays in specialized PTSD treatment centers. As in-patient care can be costly, it’s important to verify the extent of coverage with your provider to avoid unexpected expenses.

Insurance Coverage for PTSD in Military Members and Veterans

PTSD is common among military members and veterans due to the nature of their service. Fortunately, several options are available to active and former military personnel:

- TRICARE: For active-duty military members, TRICARE often covers mental health services, including PTSD treatment.

- Veterans Affairs (VA): The VA provides mental health services, including therapy, medication, and group counseling, specifically for veterans.

- Veteran-Specific Programs: Military members can also access additional resources and support groups through organizations like the VA and nonprofits dedicated to veteran mental health.

Veterans Affairs may also provide financial assistance and disability compensation for PTSD-related conditions, making it more accessible for veterans to receive ongoing support.

Navigating Insurance for PTSD Treatment: Tips and Considerations

Understanding your insurance coverage for PTSD can be overwhelming. Here are some helpful tips for navigating your policy and maximizing your benefits:

1. Confirm Coverage Before Treatment

Before beginning treatment, contact your insurance provider to clarify your benefits. Ask about:

- In-Network Providers: Choosing an in-network therapist or psychiatrist can significantly reduce your out-of-pocket costs.

- Copayments and Deductibles: Confirm the copayments required for each session and whether you need to meet a deductible before coverage begins.

- Session Limits: Some plans may limit the number of therapy sessions covered per year, so it’s essential to plan accordingly.

2. Ask About Alternative Payment Options

If your copayments are high or your insurance doesn’t cover all services, consider using a Health Savings Account (HSA) or a Flexible Spending Account (FSA) for additional support. These accounts offer tax-free funds that can be used toward medical expenses, including mental health treatment.

3. Explore Online Therapy Options

For those concerned about costs, online therapy can be a more affordable alternative. Platforms like CEREVITY.com offer licensed therapists who specialize in PTSD treatment and accept a range of insurance plans. For specific guidance, check out our article on Digital Therapy, which explains the benefits and options available for virtual mental health services.

4. Look Into Community Resources

Community organizations, mental health nonprofits, and support groups often provide free or low-cost therapy options. Consider reaching out to local mental health organizations or veteran support groups for additional resources and guidance.

Final Thoughts: Accessing Affordable PTSD Treatment

Navigating PTSD treatment options and insurance coverage may feel daunting, but resources and support are available. From in-person and online therapy to support through military organizations, there are many ways to receive the care you need. Remember that the Mental Health Parity Act protects your right to mental health care, meaning insurance providers are required to offer equitable coverage for PTSD.

At CEREVITY, we understand the importance of accessible mental health care. Our platform offers affordable, compassionate PTSD treatment through licensed professionals who are ready to support you. If you’re interested in learning more about your options, reach out today to see how CEREVITY can help you on your journey